- Prairie Routes Newsletter

- Posts

- Ag News Weekly Recap

Ag News Weekly Recap

Your December 10th agriculture news is here!

PRAIRIE ROUTES

NEWS

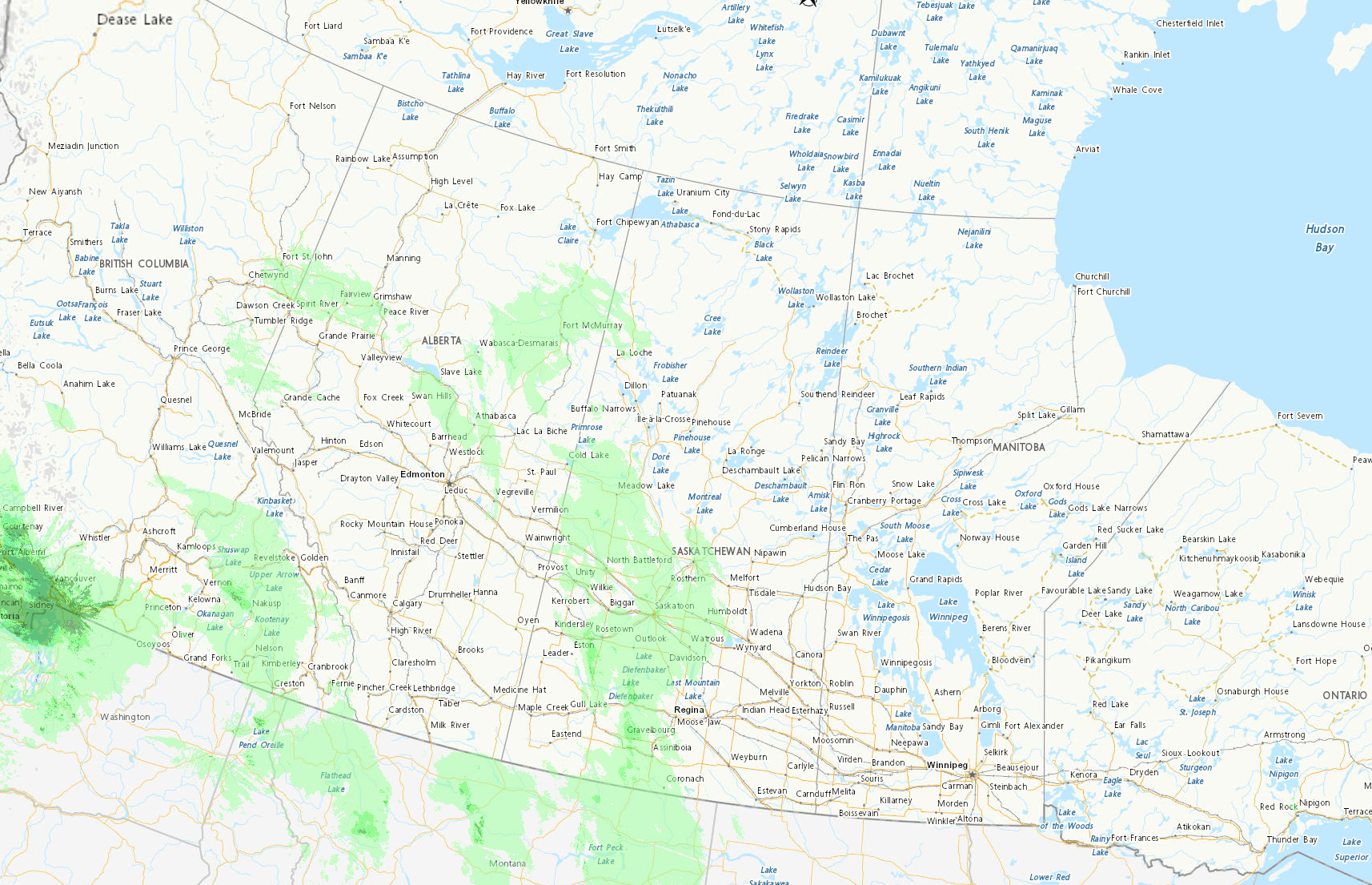

Good morning, a brief warm-up is expected early this week with temperatures reaching -3 to -5°C in Saskatchewan and Manitoba, followed by another cold snap in Alberta dropping to -20 to -22°C. Frequent snow flurries and light accumulation will continue throughout the week across the prairies, with midweek bringing significant snowfall ahead of warming conditions. Producers should monitor livestock during cold snaps and prepare for ongoing winter weather.

MARKET PULSE

Commodity Market Update

Jan & Feb futures brief for today

Canadian grain and oilseed futures are marching to the beat of their own drum this week, with the December USDA WASDE report providing support to North American corn while a record Statistics Canada canola crop has crushed canola prices below critical technical support. The real story for Canadian producers: basis levels are diverging sharply across commodities, creating both opportunities and risks.

Canadian Spring Wheat (Jan '26) is holding up far better than canola, trading near $5.25 USD (roughly CAD $7.35/bu delivered Fort William), despite Statistics Canada confirming a record 39.955 million tonne all-wheat harvest.

Canadian Malting Barley cash bids are running CAD $6.10-$6.25/bu on the Prairies, well-supported by strong demand from both domestic brewers and Asian importers. With Statistics Canada forecasting barley production at 9.485 million tonnes (up 6.7% year-over-year), the large supply is being absorbed by steady end-user demand rather than speculative holding.

Corn basis in Canada is particularly attractive right now. The USDA's December WASDE cut U.S. corn ending stocks by 125 million bushels entirely on export strength, signaling robust global demand. Canadian corn buyers are paying up relative to Chicago futures, with basis levels near the strongest seen in months. Producers in Ontario and Quebec have genuine selling opportunities at current levels.

Canadian Live Cattle futures are trading firmer, with February contracts near USD $226.95/cwt (roughly CAD $312/cwt), reflecting tight North American feeder supplies and strong packer demand. The critical factor for Canadian producers: the U.S. herd is at multi-decade lows, and packers are aggressively chasing Canadian feeder cattle and finished cattle to maintain slaughter capacity through winter.

Canadian Feeder Cattle demand is very strong. Medium and large 1 feeder steers (603-646 lbs) are bringing USD $384-$423/cwt at U.S. auctions, translating to roughly CAD $530-$585/cwt, which is compelling for Western Canadian ranchers. The shortage of feeders means that quality calves are in high demand, and basis levels favor forward sales for calf suppliers.

Natural Gas is of particular relevance for Canadian agricultural inputs and logistics. Jan futures closed at $4.574/MMBtu Tuesday, well below recent highs but still supporting the profitability case for Canadian energy-intensive operations like ammonia production. Milder weather forecasts through December 23 are pressuring prices, but winter heating demand through February could still provide tactical support.

How to position into the day

Spring Wheat: Hold firm, quality premiums are supporting prices better than global wheat benchmarks. Basis levels remain attractive for forward commitments.

Corn: Don't leave money on the table, Canadian basis is at multi-month highs on U.S. export strength. Lock in forward sales where possible.

Cattle: Strong feeder demand and tight finished supplies support staying long. Ranchers with spring/summer calves should consider forward contracts.

Barley: Steady demand supports current basis; no urgency to sell everything right now, but use any rallies to lock in quality sales.

Not financial advice.

Data sources: Statistics Canada, Barchart.com, Heritage Cooperative, MRGA, CmdtyView

TRENDS

📈 The Bulls and 📉 The Bears

📈 Bullish:

WASDE Export Demand Validates Global Market Strength - The December USDA WASDE report confirmed that the 125 million bushel cut to U.S. corn ending stocks came entirely from increased export demand, not from lower production. This validates that the global demand backdrop is more resilient than many feared, supporting the structural case for higher corn prices despite a massive harvest.

Canadian Wheat Exports at Record Pace Despite Record Production - Statistics Canada's December report confirmed a record 39.955 million tonne all-wheat harvest for 2025, yet the market has shown remarkable resilience and commercial buyers are actively bidding for supplies. The record-setting export pace to date is absorbing a large portion of the crop, with commercials confident they have plenty of good quality supplies to offer the world.

CN Sets New Monthly Grain Movement Record; Logistics Capacity Expanding - CN hauled a record 3.28 million tonnes of grain from Western Canada in November, surpassing the previous November 2020 record by 230,000 tonnes. This marks the third consecutive month of increased grain movement, and crop-year-to-date shipments are now 13.7 MMT versus 12.0 MMT last year, nearly 14% ahead of the three-year average.

📉 Bearish:

Statistics Canada Canola Production Crushes Market Expectations; Record 21.8 MMT Output - Statistics Canada's December 4 production report confirmed canola at a record 21.804 million tonnes for 2025, exceeding the September estimate of 20.03 mmt and setting a new record above the 2017 peak of 21.458 mmt. While the number came in below the most aggressive pre-report whisper numbers of 22.1 mmt, it still represents a 2.565 million tonne increase year-over-year and has triggered a significant selloff in futures.

Soybean Exports Running 45% Behind Pace; Chinese Buying Remains Elusive - Despite hopes for Chinese purchases following mid-November tariff suspensions, U.S. soybean exports remain dismal, running 45% behind last year's pace year-to-date. The most recent weekly data showed negligible shipments, with zero confirmed cargoes moving to China.

Trump Threatens Potash Tariffs; Saskatchewan's Export Industry Braces for Impact - President Trump has now added potash to his tariff target list, suggesting severe tariffs could be imposed on Canadian fertilizer exports. Saskatchewan produces 12-13 million tonnes of potash annually and exports roughly half to the U.S., while the U.S. produces only 400,000 tonnes domestically.

Want to Sell More Meat and Grain—Profitably?

Prairie Routes connects family farms with seasoned experts for 1-on-1 coaching tailored to your business. Whether you’re looking to grow your market, boost margins, or streamline sales, we’re here to help.

Book your free consult today and see how we can help your farm thrive.

INCASE YOU MISSED IT

Quick Hits on Policy and Relevant News

🌍 FCC Report: $12B in Food Exports Could Shift Away from U.S. Market

Farm Credit Canada has identified $12 billion in food and beverage exports that could be redirected away from the U.S. market if trade uncertainty persists. The report suggests $2.6 billion in current exports could service Canadian domestic demand, while $9.4 billion could be redirected to European and Asian markets. Particularly France, Germany, the Netherlands, the UK, and China. BNN Bloomberg

🏭 Maizex Seeds Announces $8.8M Facility Expansion in Blenheim, Ontario

Maizex Seeds, the seed division of Sollio Agriculture, broke ground on an $8.8 million facility expansion in Blenheim, Ontario, focused on advancing seed genetics and production capacity. The investment signals confidence in long-term Canadian agriculture demand despite trade headwinds. Canadian Newswire

🚂 CN Sets November Grain Movement Record; Third Consecutive Month of Growth

Canadian National transported a record 3.28 million tonnes of grain from Western Canada in November, surpassing the November 2020 record by 230,000 tonnes. Crop-year-to-date shipments are now 13.7 MMT, 14% ahead of the three-year average and showing strong momentum heading into the December-January peak shipping window. Progressive Railroading

🎪 Canadian Western Agribition Closes with 1,200+ International Attendees

The 2025 Canadian Western Agribition wrapped November 29 in Regina with over 1,200 international guests from 63 countries participating. The event featured record livestock entries, the Maple Leaf Finals Pro Rodeo, and the Grain Expo, positioning Canada as a global hub for agricultural commerce and genetics. The National Circle for Indigenous Agriculture and Food (NCIAF) also hosted a 400-person Indigenous Agriculture Summit during the event. Canadian Western Agribition

SUGGESTED READ

It takes a fresh perspective and an open mind to find, and incorporate, all the new financial influences shifting farm margin potential…

Failure is not the opposite of success: it’s part of success.

Until next time,

Prairie Routes News

Want to help the newsletter grow?

Forward this newsletter to a friend or colleague, it’s free!