- Prairie Routes Newsletter

- Posts

- Ag News Weekly Recap

Ag News Weekly Recap

Your December 3rd agriculture news is here!

PRAIRIE ROUTES

NEWS

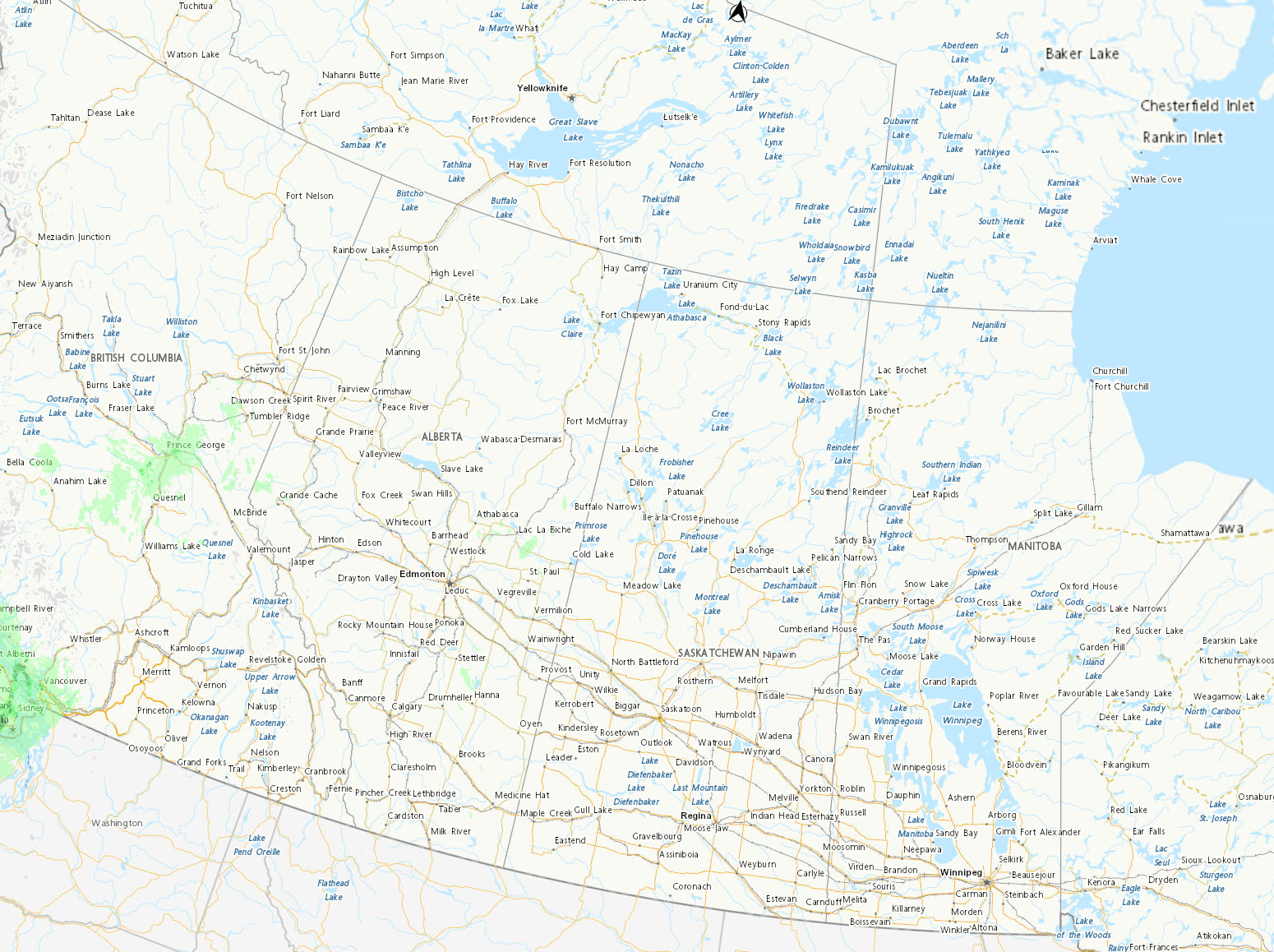

Good morning, a strong cold front will maintain a chilly grip on the Canadian prairies this week, with daytime highs between -8°C and -16°C and overnight lows dipping below -20°C. Snowfall is expected mainly in Alberta and Manitoba midweek, with scattered flurries lingering through the week. Bitter wind chills nearing -35°C will create hazardous conditions for travel and livestock, so producers should prepare for ongoing winter challenges.

MARKET PULSE

Commodity Market Update

Jan & Feb futures brief for today

Markets are relatively subdued as traders await key data points in early December, but underlying tensions in trade and supply are creating notable divergence across commodities.

Crude oil (WTI Jan '26) is holding steady at $59.08/barrel (up 0.75%), finding support from geopolitical risks in Eastern Europe and expectations that OPEC+ will maintain production cuts through Q1 2026 at its upcoming meeting. Despite bearish inventory data showing gasoline stocks rising, the market is pricing in a risk premium, effectively setting a floor near $58.

Soybeans (Jan '26) are trading at $11.25¼/bu (up ½ cent), attempting to stabilize after weakness earlier in the week. While the market has been pressured by slow U.S. export sales, which are running nearly 57% behind last year's pace. There is optimism that recent purchase inquiries from China could translate into firm orders. However, the 11.2-million-tonne global stock cushion limits any significant upside breakout without a weather shock in South America.

Corn (Mar '26) has shown resilience, trading at $4.49/bu (up ~4 cents) as cash markets firm up. Buyers are paying up for prompt delivery due to tight immediate supplies, with Ukrainian shipments lagging significantly behind last season's pace. This export gap is creating a window for U.S. corn to capture market share, supporting prices above the $4.45 level despite the massive global harvest.

Live Cattle (Feb '26) remains a bright spot, closing higher at approximately $211.23/cwt (up ~$3.97-$4.60 in recent sessions). The market is driven by structural supply tightness, with the U.S. herd at multi-decade lows. Packers are chasing inventory to meet holiday beef demand, pushing cash prices higher in the south ($220/cwt) and pulling futures up in sympathy.

How to position into the day

Soy / Grains: Corn offers the best relative strength on export optimism; look for support at $4.45 to hold. Soybeans are a "prove it" trade. Wait for confirmed export sales before chasing rallies.

Energy: Crude is buyable on dips to $58 with a tight stop, playing the OPEC+ extension thesis.

Livestock: The trend in cattle is up, but volatility is high. Producers should use this rally to hedge Q1 production, as basis levels are attractive.

Not financial advice.

Data sources: Barchart.com, Investing.com, Morningstar, TradingEconomics.com

TRENDS

📈 The Bulls and 📉 The Bears

📈 Bullish:

FCC Report: Productivity Boost Could Add $30B to Farm Income - A new Farm Credit Canada report outlines a path for Canadian agriculture to generate an additional $30 billion in net farm income by restoring productivity growth to 2% annually. The report highlights that while Canada is a global leader, recent productivity gains have slowed. Investing in innovation and efficiency now could unlock massive economic potential and create 23,000 new jobs.

Saskatchewan Harvest Wraps with Above-Average Yields - Final crop reports indicate Saskatchewan farmers achieved yields above historical averages for most major crops despite variable weather. Hard red spring wheat averaged 51 bu/ac, durum hit 41 bu/ac, and canola yielded 34 bu/ac. High-quality grades were also reported, with 65% of spring wheat grading 1CW.

China Raises 2025 Grain Stockpiling Budget by 6.1% to $18 Billion - Beijing has increased its 2025 budget for stockpiling grain, edible oils, and other materials by 6.1% to 131.66 billion yuan ($18.12 billion). This strategic move is explicitly linked to "preparing for a prolonged trade conflict" and ensuring food security amid geopolitical tensions.

📉 Bearish:

South American Weather Near-Perfect; Crop Stress Window Closing - While North American markets focus on demand, the supply side in South America is looking increasingly heavy. Weather models through mid-December show near-ideal conditions across key growing regions in Brazil and Argentina, with a mix of beneficial rain, sunshine, and a lack of extreme heat advancing crop development. Analysts note that the window for any significant weather-related yield loss is rapidly closing, likely within the next 3-4 weeks.

Soybean Exports Running 45.6% Behind Last Year - USDA data confirms a major slump in U.S. soybean exports, with shipments since September 1 totaling just 11.87 MMT, a staggering 45.6% decline compared to last year. The most recent weekly data showed shipments of under 1 million tonnes, less than half the volume of the same week a year ago, with zero confirmed cargoes to China.

Canola Technical Break Signals Further Downside - January canola futures have violated key technical support, slipping below the 20-day moving average and shedding over $5/tonne to start December. The move is driven by weakness in correlated markets like European rapeseed and Malaysian palm oil, rather than specific Canadian fundamentals.

Want to Sell More Meat and Grain, Profitably?

Prairie Routes connects family farms with seasoned experts for 1-on-1 coaching tailored to your business. Whether you’re looking to grow your market, boost margins, or streamline sales, we’re here to help.

Book your free consult today and see how we can help your farm thrive.

INCASE YOU MISSED IT

Quick Hits on Policy and Relevant News

🐔 New Bird Flu Outbreaks Confirmed in Ontario Turkey Flocks

The CFIA has confirmed five new outbreaks of highly pathogenic avian influenza (HPAI) in commercial turkey flocks in Strathroy-Caradoc, Ontario, as of early December. Quarantine zones have been established, and depopulation measures are underway to contain the spread. This uptick in cases signals a renewed biosecurity risk as winter sets in. London Free Press

📉 Bill C-282 Faces Uncertainty After Senate Amendment

A private member's bill intended to protect supply management in trade deals is in limbo after the Senate passed an amendment exempting existing agreements and renegotiations (like CUSMA). Proponents argue this guts the bill's protection, while export-oriented cattle groups argue the flexibility is needed to preserve Canada's broader trade leverage. The bill now likely heads back to a deadlocked House of Commons. ABP Daily

🌿 Industry Report: 30% Fertilizer Emission Cut "Unrealistic"

A report commissioned by Fertilizer Canada and the Canola Council argues that the federal government's target to reduce fertilizer emissions by 30% by 2030 is not achievable without cutting yields. The report suggests a 14% reduction is more realistic, warning that pushing for 30% could cost Canadian farmers nearly $48 billion in lost crops over the next decade. CBC News

🔬 Research Funding Shift: Less for Production, More for Climate

A new University of Calgary study reveals a significant shift in Canadian agricultural research funding over the last decade. While funding for environmental sustainability has grown by nearly 26% annually, investment in "production and growth" research has actually declined. This realignment raises questions about long-term productivity gains versus climate adaptation. University of Calgary

🚜 Agricultural Manufacturing Warns of Tariff Job Losses

The Agricultural Manufacturers of Canada (AMC) stated that U.S. tariffs would jeopardize 1 in 9 jobs in the sector. They are calling for a unified "Team Canada" approach to defend the integrated North American supply chain, noting that the U.S. actually runs a trade surplus with Canada in agricultural equipment. Farm Equipment

Lead by doing the tough, visible work when it matters most.…

Until next time,

Prairie Routes News

Want to help the newsletter grow?

Forward this newsletter to a friend or colleague, it’s free!