- Prairie Routes Newsletter

- Posts

- Ag News Weekly Recap

Ag News Weekly Recap

Your December 31st agriculture news is here!

PRAIRIE ROUTES

NEWS

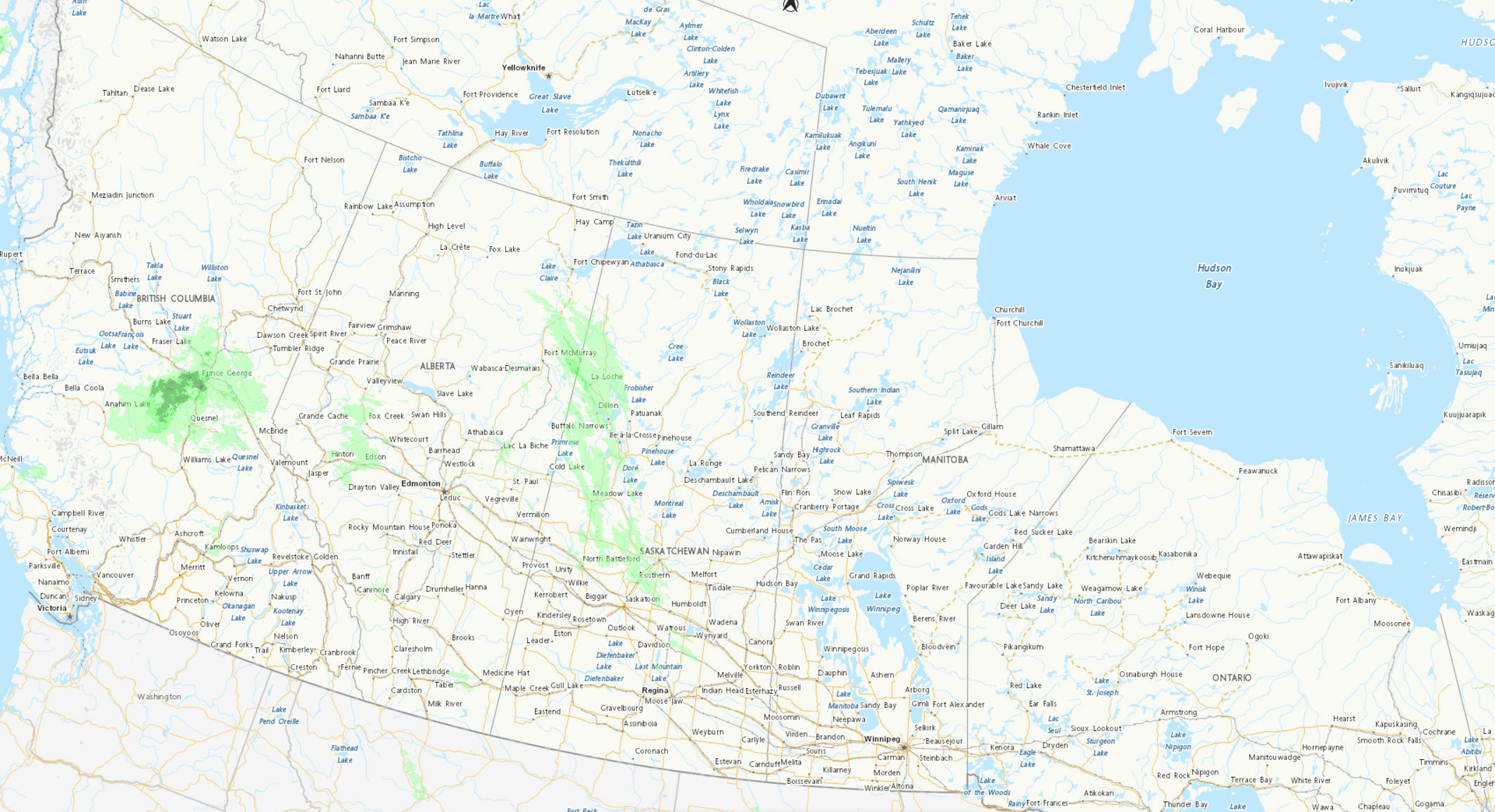

Good morning, the Canadian prairies will see a brief moderation in temperatures this week, with highs near –5°C to –10°C in many areas as milder Pacific air moves in, but cold Arctic air will remain entrenched in the north. Scattered snow showers and flurries will continue, especially across central and northern Saskatchewan and Manitoba, with a chance of light accumulation through midweek. Wind chills will remain a concern in exposed areas, and producers should continue to monitor livestock closely as conditions remain winter-like heading into early January.

MARKET PULSE

Commodity Market Update

Feb & Mar futures brief for today

As 2025 closes in record volatility, February and March futures are settling into their final positions before the calendar flips, with corn holding structural strength, hogs consolidating after holiday weakness, and crude oil posting its worst annual performance since 2020.

Corn (Mar '26) closed December 31 at $4.405/bu, holding above the critical $4.40 support level. The March/December spread remains tight at just 8.25 cents, indicating strong underlying demand for old-crop supplies. Canadian corn basis in Ontario continues at $1.35–$2.12 over March futures for old-crop.

Soybeans (Jan '26) closed at $10.76/bu, holding support above $10.50 but down significantly year-to-date as China has not materially increased purchases despite the November Trump-Xi commitment. The January contract trades at the 16th percentile of the past five-year price distribution, indicating deep undervaluation if China begins buying. Canadian basis holds steady at $3.18–$3.50 over January futures. Watch: The January USDA report could provide fireworks if yield cuts of 1-2 bu/acre materialize, carving 160 million bushels off ending stocks.

Live Cattle (Feb '26) closed at $223.825/cwt, consolidating after holiday trading. U.S. cattle on feed is down 2% year-over-year at 11.7 million head, with November feedlot placements 11% below 2024. Feeder cattle index strength at $356.00 (up $6.68 on Dec 26) signals feedlot operators are aggressively bidding despite packer margin pressure.

Lean Hogs (Feb '26) closed at $84.60/cwt (down from recent highs of $85.95). The December Hogs and Pigs report surprised with total inventory up 1% year-over-year and market-ready hogs up 3%. The breeding herd hit an 11-year low at 5.95 million head, but farrowing intentions for December-February 2026 are up 2% year-over-year, adding supply pressure. The CME Lean Hog Index sits at $83.84, creating a 76-cent premium to cash.

Natural Gas (Feb '26) closed at $3.77/MMBtu, down 5.07% after warmer weather forecasts triggered long liquidation. EIA raised 2025 U.S. production to 107.74 bcf/day (near record highs), creating structural oversupply. For producers: Natural gas remains structurally weak heading into 2026, moderately pressuring processed feed prices.

Not financial advice.

Data sources: Grain Farmers of Ontario, Barchart.com, CME Group, TradingEconomics.com, USDA

TRENDS

📈 The Bulls and 📉 The Bears

📈 Bullish:

Canadian CWRS Wheat Maintains Quality Excellence; 2025 Harvest Delivers Consistent Premium-Grade Supplies - Canada's 2025 harvest of Canada Western Red Spring (CWRS) wheat has delivered consistent premium-quality supplies across the Prairies, maintaining the reputation that commands global demand premiums. Despite record production of 39.96 million tonnes, strong export pace year-to-date and quality consistency are supporting firm basis levels and commercial bidding strength.

Feeder Cattle Index Rebounds $6.68 on December 26; Feedlot Operators Aggressively Bidding - The CME Feeder Cattle Index rebounded to $356.00, signaling renewed aggression from feedlot operators securing feeder supplies despite packer margin pressure. Alberta feeder calf prices remain $400–$700/head above December 2024 levels, providing genuine selling opportunities for calf producers.

Corn Demand Strengthens on Export Surge; USDA Raises Forecast 125 Million Bushels - The USDA's December WASDE report increased U.S. corn export forecast by 125 million bushels, reflecting robust global demand despite a record U.S. harvest. March/December futures spread compression to just 8.25 cents signals genuine old-crop demand, not speculative strength.

📉 Bearish:

Hogs & Pigs Report Surprises Bullish on Total Inventory; Farrowing Intentions Rising - The USDA's December 1 Hogs and Pigs report revealed total hog inventory at 75.5 million head - up 1% year-over-year - contradicting trade expectations for a decline. Market-ready hogs weighing 180+ lbs totaled 13.852 million head, up 3% year-over-year, flooding the market with supply precisely when seasonal demand declines post-holidays. December-February 2026 farrowing intentions are up 2% year-over-year, adding further supply pressure.

Breeding Herd Hits 11-Year Low; Structural Tightness Masked by Near-Term Supply Glut - While breeding inventory contracted 0.9% year-over-year to 5.95 million head - the smallest December 1 breeding herd since 2014 - this structural tightness is overshadowed by near-term market-ready glut. The bifurcated market (tight future supply vs. large current supplies) creates classic boom-bust trading conditions.

Crude Oil Posts Worst Annual Performance Since 2020; IEA Forecasts 3.8 MMbpd 2026 Global Surplus - WTI crude oil fell 21.1% in 2025 - the steepest annual decline since 2020 - as the IEA projects a massive 3.8 million barrel-per-day global surplus in 2026. OPEC+ is expected to pause production increases when it meets January 2, offering no structural support. U.S. inventories surprised to the upside at +400,000 barrels when analysts expected a 2.6 million barrel drawdown.

Want to Sell More Meat and Grain Profitably?

Prairie Routes connects family farms with seasoned experts for 1-on-1 coaching tailored to your business. Whether you’re looking to grow your market, boost margins, or streamline sales, we’re here to help.

Book your free consult today and see how we can help your farm thrive.

INCASE YOU MISSED IT

Quick Hits on Policy and Relevant News

💰 PRIME MINISTER CARNEY EXPECTED TO VISIT CHINA IN Q1 2026 TO ADDRESS CANOLA TARIFF CRISIS

RealAgriculture founder Shaun Haney noted that Prime Minister Mark Carney is expected to visit China in Q1 2026 with hopes of easing trade tensions and removing tariffs on Canadian agricultural goods, particularly canola. However, Haney emphasized that "there's no assurance of that" and farmers should prepare for canola to potentially reach Chinese markets through alternative routes if tariffs remain in place.

🌾 2025 RECORD YIELDS DELIVERED DESPITE TARIFFS; 2026 OUTLOOK "CHALLENGING" ON TRADE UNCERTAINTY

Shaun Haney's year-end recap highlighted that while 2025 delivered record crop yields following 2024's drought, farmers face headwinds from Chinese tariffs on canola, geopolitical supply issues, and rising input costs (+12% estimated). Hopes for trade resolution rest on PM Carney's planned Q1 2026 China visit.

📋 NEW LIVESTOCK TRACEABILITY RULES SET TO ROLL OUT IN 2026; PRODUCERS MUST PREPARE NOW

The Canadian Cattle Identification Agency (CCIA) announced that amendments to Canada's livestock traceability rules will be published in Canada Gazette Part II in spring 2026, expanding requirements to goats and cervids and introducing mandatory movement reporting across all regulated species. CCIA has already launched a new movement record module in the Canadian Livestock Tracking System (CLTS) to allow producers to adjust workflows before regulatory deadlines.

🎯CANADIAN PORK COUNCIL REJOINS CANADIAN FEDERATION OF AGRICULTURE AS NATIONAL COMMODITY MEMBER

The Canadian Pork Council (CPC) has officially rejoined the Canadian Federation of Agriculture (CFA) as a national commodity group member after the CFA board unanimously voted to welcome back the pork producer group representing over 7,000 farms across nine provinces. The move signals unified agricultural advocacy heading into challenging 2026 trade negotiations.

🐄CANADIAN CATTLE HERD LOWEST SINCE 1980; BEEF PRICES PROJECTED TO RISE FURTHER IN 2026

Canada's cattle inventory has shrunk to its lowest level since 1980, with retail beef prices climbing 16% over the past year. University of Guelph economist Mike von Massow confirmed that beef prices are expected to rise further in 2026, though at a slower pace than recent years, as the herd gradually rebuilds.

📈CANADIANS RANK AGRICULTURE AS TOP PRIORITY FOR FEDERAL SUPPORT; 29% LIST IT FIRST

A Nanos Research poll found that 29% of Canadians ranked agriculture as the top priority for federal government support, with another 19% ranking it second, making the sector the clear winner in public opinion on government spending priorities. The strong public support may pressure the Carney government to announce farm support packages heading into 2026.

🌱 TIP OF THE WEEK: Fall Soil Sampling Reveals Spring Opportunities

Soil test results from December sampling show nutrient availability at winter lows when biological activity slows. This is actually ideal for planning: use these baseline readings to calculate exactly how much N, P, and K your 2026 crops will need, accounting for residual nutrients and mineralization rates. When spring soil temperatures climb above 5-7°C, microbial activity accelerates - time your fertilizer applications to coincide with peak plant demand, not peak microbial release.

Learn more:

Canola Council of Canada: Soil Sampling – Timing, Technique, Interpretation

Alberta Pulse Growers: Spring vs Fall Soil Sampling

Manitoba Cooperator: Fall Soil Testing Tips for Smart Fertilizer Plans

The secret of getting ahead is getting started…

Until next time,

Prairie Routes News

Want to help the newsletter grow?

Forward this newsletter to a friend or colleague, it’s free!