- Prairie Routes Newsletter

- Posts

- Ag News Weekly Recap

Ag News Weekly Recap

Your November 5th agriculture news is here!

PRAIRIE ROUTES

NEWS

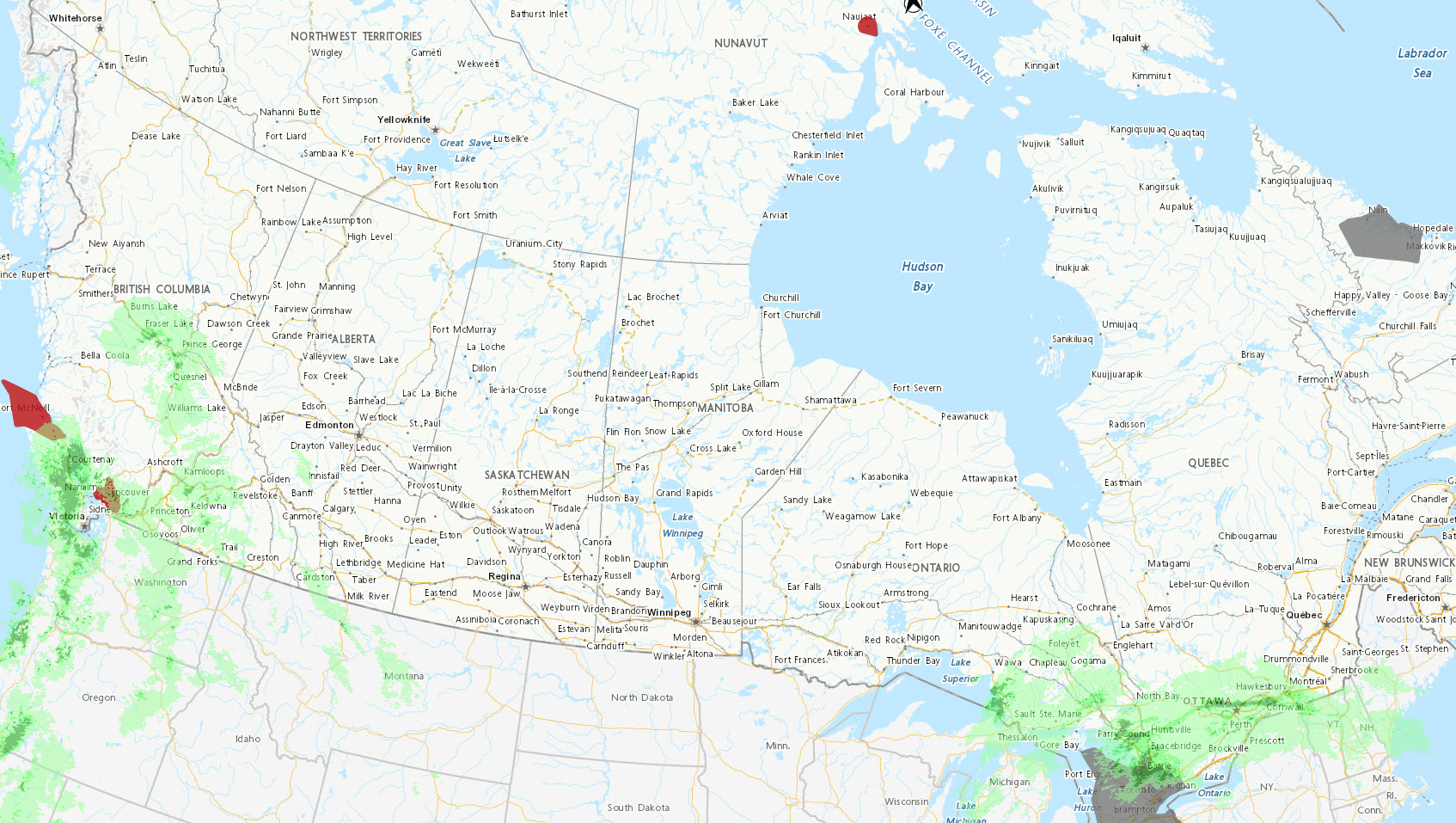

Good morning, a shift in weather is underway across the Canadian Prairies this week as a weak Pacific system moves in. Light rain and wet snow spread across Alberta and Saskatchewan through midweek, with daytime highs in the 7–10°C range before cooler Arctic air filters in late Friday. Manitoba sees rain developing Thursday into Friday, with temperatures near 9–11°C before gusty northwest winds usher in a drop toward seasonal or slightly below-normal highs this weekend. Saturday brings a short window of milder, drier conditions with highs around 10–12°C, but another push of cold northern flow arrives early next week, returning much of the region to single-digit daytime temperatures and widespread frost potential.

MARKET PULSE

Commodity Market Update

Dec & Jan futures brief for today

Soybeans consolidate after a blistering two-week rally. January futures pushed to $11.35¾, a 15-month high after China's commitment to purchase at least 12 million tonnes by year-end and 25 million tonnes annually over three years under the Trump-Xi framework. Bangladesh added institutional demand with a $1.25 billion purchase commitment, triple 2024 volumes. But profit-taking is inevitable after such a sharp advance, with technical overbought conditions setting the stage for a corrective dip toward support at $10.63¾. StoneX trimmed its 2025 US soybean yield estimate to 53.6 bu/acre, and traders await the November 14 USDA Crop Production report. Meanwhile, a stronger US dollar above 100 and cheaper Brazilian supplies pressure the upside.

Corn holds steady near $4.31½ as traders eye the November 14 USDA update. December contracts face resistance at the 200-day moving average of $4.36½ and $4.37, with support holding at the 20-day average of $4.24¼. S&P Global estimates 2025 US corn yield at 185.5 bu/acre with output steady at 16.803 billion bushels, but record-large Brazilian output threatens US global market share. Export demand remains solid, but without fresh surprises from the USDA, expect consolidation.

Wheat eases 1-4 cents lower after December Kansas City rallied to $5.30/bu on US-China trade optimism. Gains remain capped by ample global supplies. Russia's latest forecast sits at 87.8 million tonnes citing record Siberian yields, while Argentina projects 23 million tonnes. MGEX December spring wheat trades at $5.57/bu, down a half-cent, with the Minneapolis-Kansas City spread compressed to 23 cents/bu (well below the normal 30-35 cent range) suggesting spring wheat is undervalued. Chinese interest in US wheat continues, but no purchase confirmations have materialized yet.

Crude oil treads water near $60.12/barrel as conflicting signals collide. API data revealed crude inventories surged 6.5 million barrels, the largest weekly build since early July, far exceeding expectations for a draw. Simultaneously, US sanctions on Russia are showing teeth: Moscow's seaborne exports slumped their most since January 2024, while China, India, and Turkey paused sanctioned cargo purchases. OPEC+ paused output hikes through Q1 2026 as analysts expect 2026 surplus, and a stronger US dollar above 100 adds downside pressure. December WTI closed down $0.42 at $60.14/bbl.

Natural gas collapsed over 2% to $4.22/MMBtu after rallying to an eight-month high of $4.34. Warmer forecasts through mid-November are subduing heating demand, while Average Lower-48 production rises to record levels, swelling storage 4% above seasonal averages. LNG exports remain strong at 17.2 bcf/day, absorbing excess US supply.

Gold stabilized above $3,970/oz after plummeting from historic record highs, still up 49% year-over-year. Consolidation near current levels allows traders to assess whether the correction is complete or if lower prices await.

Livestock remains hostage to political noise. December live cattle closed at $226.58/cwt as rumors swirled about President Trump reopening the Mexican border to feeder cattle imports. Triggering kneejerk selling despite tight domestic supplies. Feeder cattle collapsed, with January down $9.55 to $324.88/cwt and March down $11.65 to $319.65/cwt. CME expanded daily limits to $10.75 for live cattle and $13.75 for feeders. December lean hogs hit 3.5-month lows at $79.925, extending a five-week downtrend. The CME Lean Hog Index fell another 21 cents to $90.98, with pork cutout value falling $2.48 to $99.17/cwt. Hog futures are oversold on the chart but lack fundamental support, bounces remain technical relief only.

How to position into the day

Canola / Grains / Soybeans: Beans overbought after $1.11 rally and face profit-taking—watch support at $10.63. Corn and wheat consolidate pending the November 14 USDA report. Dollar strength above 100 headwinds all grains.

Energy / Oil: Crude finds temporary support from sanctions but faces structural oversupply. Scale into shorts on rallies toward $62; downside risk to $55–57 remains.

Natural Gas: Warmer forecasts and rising production keep pressure near $4/MMBtu. LNG exports prevent sharper declines but weakness likely.

Gold / Metals: Safe-haven thesis intact after correction. Dip-buyers below $3,900 see long-term value given rate-cut delays and geopolitical tensions

.

Livestock: Cattle sentiment hostage to political headlines. Hogs severely oversold, use weakness to position for eventual bounce, but trade with trend until chart structure improves.

Not financial advice.

Data sources: Producer.com, Barchart.com, CMEGroup.com, TradingEconomics.com, AgMarket.Net

TRENDS

📈 The Bulls and 📉 The Bears

📈 Bullish:

Western Canada wheat quality surprises to the upside; No. 1 grades tracking near or above long-term averages - Early 2025 CWRS wheat quality reports show average protein levels holding at 13.9 percent across Manitoba, Saskatchewan, Alberta, and B.C., consistent with long-term trends and positioning CWRS as premium global milling wheat. Over 89 percent of samples tested below the DON (mycotoxin) limits despite concerns over Fusarium damage in some regions. Downgrading factors like hard vitreous kernels and mildew are appearing, but the majority of samples are grading No. 1.

Feeder cattle index rebounds sharply; OKC auction activity signals improved demand - The CME Feeder Cattle Index jumped $3.46 to $346.79 on November 3 after sharp Monday losses, signaling a temporary stabilization in sentiment. The weekly Oklahoma City feeder cattle auction drew 5,544 head with steer calves noted $20-30 higher and heifers and feeder steers $10-25 higher. Recent cash trade ranged $230-$232/cwt in northern regions with Southern sales at $235-$237/cwt.

Agri-Trade 2025 Innovations Competition highlights $25,000 in prizes for breakthrough agricultural technologies - The Ag Innovations Competition is underway as part of Agri-Trade in Red Deer, Alberta (November 5–7, 2025), offering $20,000 grand prize and $5,000 Farmer's Choice Award for innovative agricultural products and technologies. Five finalists receive on-site exposure to thousands of industry professionals, social media coverage, and potential commercial opportunities. Previous winners have secured commercial deals and national recognition.

📉 Bearish:

Senecavirus A export disruptions hit eastern Canadian cull sow assembly—could expand westward - Senecavirus A (SVA) lesions detected on cull sows sent to US processing facilities have triggered USDA export bans on at least three Ontario cull sow assembly sites. The APHIS and USDA revoked export eligibility, forcing full cleanout and disinfection before sites can resume operations. A process expected to take an undetermined amount of time. This disruption affects assembly sites accepting cull animals from Quebec, the Maritimes, and Ontario.

Fertilizer prices surge 30% above 2025 planning estimates; urea tops $850/tonne amid margin squeeze - Fertilizer costs have climbed significantly above Manitoba Agriculture's 2025 crop cost-of-production guide, with urea jumping to $850-$900 per metric tonne, approximately 30% higher than the $690/tonne figure used in last November's calculations. DAP, anhydrous ammonia, and other major fertilizers are all higher year-over-year, compressing margins alongside depressed grain prices at harvest lows ($7/bu wheat, $13.25 canola, $11 soybeans).

H5N1 bird flu detections in US dairy cattle raise biosecurity concerns for Canadian swine producers - H5N1 highly pathogenic avian influenza detections in US dairy cattle have slowed (only 1 new detection in California in last 30 days) but 45 US states are actively surveilling and 43 repeat cases at previously cleared dairies have triggered re-quarantines. Though no cases have been confirmed in Canadian swine to date, researchers published findings suggesting natural infection with H5N1 is "very likely" in swine populations with potential for limited transmission among pigs. Canadian swine producers must maintain enhanced biosecurity to prevent introduction.

Headed to Agribition 2025? Check out the Grain Expo. Head to the link below or download the invite!

|

Prairie Routes will be attending the exclusive 13th Annual Grain Expo Conference & Tradeshow November 25 & 26, 2025 at the Queensbury Convention Centre, REAL District, Regina, SK.

Book your free consult today and see how we can help your farm thrive.

INCASE YOU MISSED IT

Quick Hits on Policy and Relevant News

👥 Agricultural Labour Shortage to Worsen 15% by 2030; Foreign Workers Now 17% of Workforce

The Canadian Agricultural Human Resource Council forecasts the domestic labour gap will balloon from 87,700 to 101,100 workers by 2030. Foreign workers now comprise 17% of the agricultural workforce (up from 10,000 in 2017 to 78,079 in 2024). With 30% of current workers retiring by 2030, streamlining temporary foreign worker programs and creating clearer paths to permanent residency are critical. CIBC Thought Leadership | CAHRC

🌱 2025 Canadian Organic Standards Review Nears Completion; 900+ Comments Submitted

The Canadian General Standards Board's review of the Canadian Organic Standards received over 900 stakeholder comments during the public consultation period. Final draft standards are expected in late 2025 with implementation in 2026. The robust participation reflects strong sector commitment to organic stewardship and standards modernization. Organic Federation of Canada

📋 Federal Budget 2025: CFA Calls for Blanket Input Remission Against U.S. Tariffs

The Canadian Federation of Agriculture urged the government to exempt farm inputs—fertilizer, equipment, seed, feed, and veterinary products—from any future countermeasures against U.S. tariffs. CFA projects Canadian agriculture could add $100 billion to GDP over 10 years if given growth-oriented policy support and CUSMA protection. CFA Budget Submission

🇧🇷 Canadian Agtech SMEs: Brazil Partnership Funding Available; November 9 Deadline

The Government of Canada's agtech partnering program with Brazil offers up to 50% funding ($6,500–$11,900 per project) for Canadian SME collaboration on precision agriculture, IoT, and AI solutions. Applications close November 9. Hello Darwin

📊 Regulatory Reform Underwhelming; More Work Needed Before 2026 Implementation

Agricultural stakeholders say the first round of federal regulatory reforms "left a lot on the table." Key priorities include modernized pesticide approvals, faster equipment registrations, and reduced input pathway red tape. The November budget and 2026 timeline represent critical inflection points for government follow-through. CFA

💰 OECD: Canada Should Invest in Climate Adaptation; Agriculture Emissions Exemptions Flagged

The OECD recommends Canada shift toward "transformative longer-term strategies" for agricultural climate adaptation as weather-related adverse events intensify. The sector's exclusion from emissions pricing creates an accountability gap. OECD Agricultural Policy Report

🔬 39 CFIA-Accredited Organic Certification Bodies Operate Across Canada

The CFIA currently accredits 39 certification bodies operating domestically and internationally to certify products under the Canada Organic Regime, supporting approximately 5,700 certified organic operations. CFIA Certification Bodies List

SUGGESTED READ

Grain trade data is far from the sexiest spoke in agriculture’s wheel, but when it suddenly disappears, market volatility escalates and people start paying attention to the value of statistics.

I don’t want to be interesting, I want to be good.

Until next time,

Prairie Routes News

Want to help the newsletter grow?

Forward this newsletter to a friend or colleague, it’s free!