- Prairie Routes Newsletter

- Posts

- Sept 9th Newsletter 🗞️

Sept 9th Newsletter 🗞️

What does hump day really mean to a farmer in season anyway....

PRAIRIE ROUTES

NEWS

🌟 Editor’s Note:

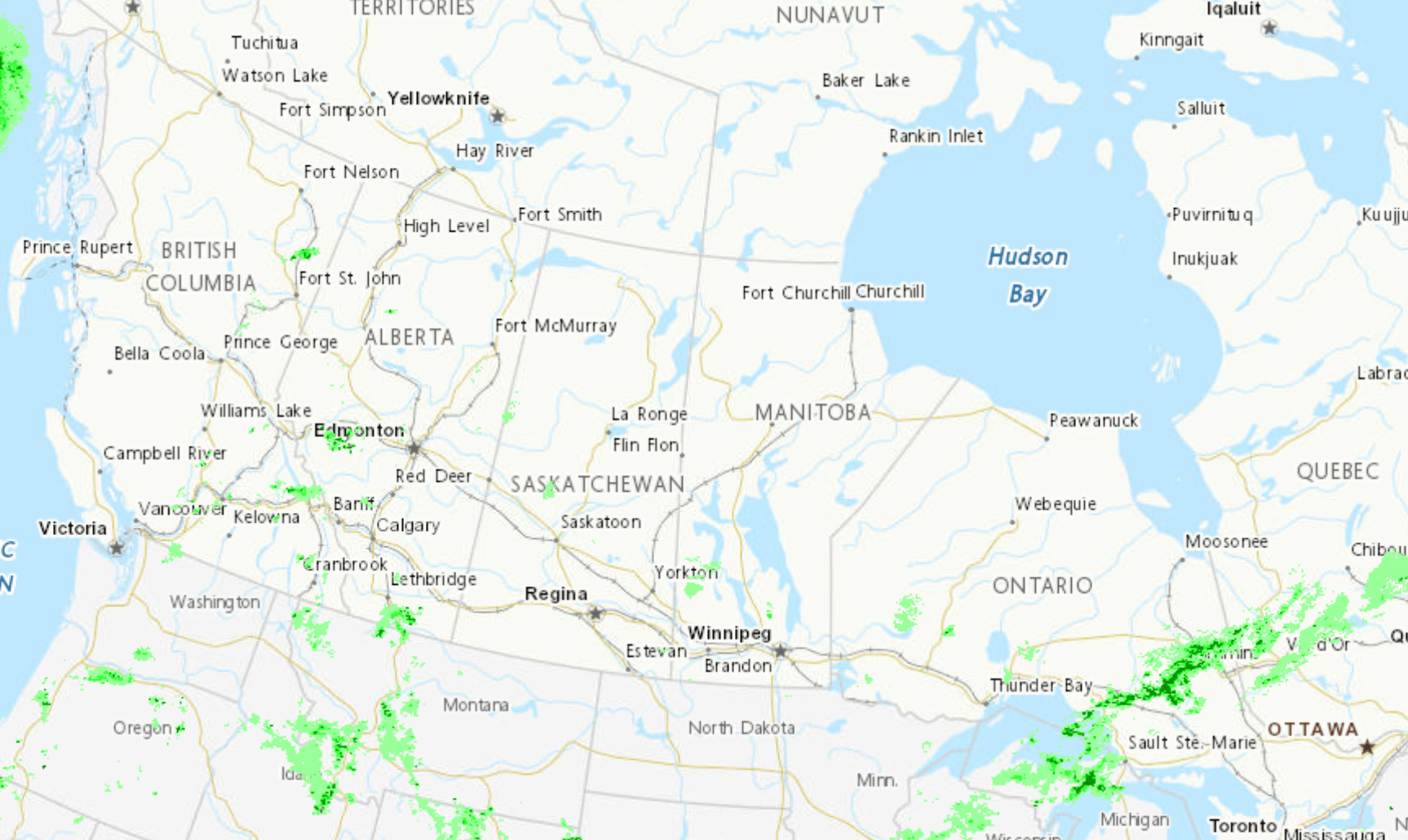

Good morning, and welcome to today’s issue! some rain moving through eastern Ontario. Thunderstorms on the forecast for later this week in Manitoba and next week for Alberta.

MARKET PULSE

1. Commodity Market Brief

⚡️ Energy — cautious bid:

OPEC+ opted for a smaller-than-expected October output hike, nudging crude higher but keeping the broader tone soft. Brent Oct ’25 hovered near the mid-$66s and WTI Oct ’25 in the low-$62s–$63s as traders weigh slower supply additions against fragile demand. Near-term balance still leans heavy unless macro data surprises to the upside.

🏅 Metals — gold’s record run, now on the Oct/Nov curve:

Gold’s safe-haven squeeze is alive on the front serial months: COMEX Gold Oct ’25 (GCV5) and Nov ’25 (GCX5) printed above $3.5k/oz on screens, in step with Tuesday’s fresh record headlines (Fed-cut odds ↑, dollar/yields ↓). Momentum stays favorable while real yields compress.

⛽️ Nat gas — firming into autumn:

Henry Hub Oct ’25 (NGV25) settled around $3.12/MMBtu; the Nov ’25 contract is higher on the curve. Output wobble and seasonal demand keep a floor under prices; LNG feedgas is the swing factor.

🌾 Grains & oilseeds — demand has to do the lifting:

Row crops remain price-sensitive to exports rather than weather. CBOT Soybeans Nov ’25 sat near $10.31¼/bu by the close, while wheat/corn tone stayed soft (we’re sticking to Oct/Nov months per your rule; most wheat/corn liquidity is Dec). Canadian oilseeds are stabilizing: ICE Canola Nov ’25 last closed C$616.80/tonne into the week, with traders watching China’s canola dispute timeline and veg-oil spreads.

🐂 Livestock — risk-off day:

Board weakness hit proteins: Live Cattle Oct ’25 finished ~230.17/cwt, Feeder Cattle Oct ’25 ~349.92/cwt, while Lean Hogs Oct ’25 bucked the trend, up to ~96.12/cwt. Near-term price action is tracking cash trade and wholesale prints more than feed costs.

What matters into today’s session:

Crude: Slower OPEC+ hikes reduce downside velocity but don’t flip the trend; watch Russian supply headlines and U.S. inventories for direction.

Gold (Oct/Nov): Pullbacks likely get bought while the market prices a September Fed cut and the dollar stays soft.

Nat gas (Oct/Nov): Seasonal demand + output dips keep a constructive bias; LNG flows are the daily tell.

Ags: Nov beans need export confirmations to extend a bounce; Nov canola trades the veg-oil complex and China duty optics.

Livestock: Keep risk tight—board action is tracking cash and midday cutout moves.

Not financial advice.

Data sources: APnews.com, Morningstar.com, MarketWatch.com, Exchange-rates.org, Agriculture.com, YahooFinance.com, Barchart.com

TRENDS

2. 📈 The Bulls and 📉 The Bears

📈 Speculators Turning Positive on Soybeans According to the latest CFTC data, money managers moved from net-short to net-long on soybeans, marking the most bullish positioning since June. Simultaneously, short bets on corn are shrinking.

📈 Corn Rally Backed by Usage Outlook The USDA’s August report raised corn usage forecasts by 545 million bushels, mainly absorbing expected supply increases. It helped fuel a recent price rebound despite big supply, signaling demand-side strength.

📉 Wheat Remains Pressured Wheat futures continue lower, slipping to contract lows. High global supply, falling EU and Russian prices, and stiff export competition are weighing on the market.

📉 Rice, Rapeseed, and Canola Sliding Across the Board Price drops are building across key soft ags: rice (-2.03%), rapeseed (-1.55%), and canola (-0.55%)—signaling widespread pressure across staple crops.

Want to Sell More Meat and Grain—Profitably?

Prairie Routes connects family farms with seasoned experts for 1-on-1 coaching tailored to your business. Whether you’re looking to grow your market, boost margins, or streamline sales, we’re here to help.

Book your free consult today and see how we can help your farm thrive.

SHARP TAKE

3. Renting Rises, Listings Fall

In the decade from 2011 to 2021, farmland classified as rented in Saskatchewan and Alberta ballooned from 25.7 million acres to 29.1 million—a 3.4 million-acre shift from owner-operated to leased ground. That includes both crop and ranch land.

This trend aligns with on-the-ground sentiment: in January 2012, 850 Saskatchewan farms were listed for sale via MLS, but as of August 2025, only 265 listings remained—underscoring how much land has drifted from sale to lease mode.

TL;DR

Over the past decade, 3.4 million acres on the Prairies shifted from ownership to renting. At the same time, farm listings collapsed from 850 to just 265 in Saskatchewan — proof that farmland is increasingly staying rented, not sold.

INCASE YOU MISSED IT

4. Quick Hits on Policy and Relevant News

🏗️ Cargill's Regina Crush Plant Coming Online – The new 1 million tonne capacity canola processing facility will start commissioning in coming months, providing crucial domestic demand as farmers lose access to China market. Two other planned Regina crush projects have been shelved. Producer.com

🏦 $4.77M Federal-Provincial Investment in Agri-Food Research – Canada and Ontario announced funding for 48 research and innovation projects through the Ontario Agri-Food Research Initiative (OAFRI), supporting 20 companies and helping farmers adopt new technologies amid U.S. tariff pressures. Projects include AI-powered mastitis detection in dairy cattle and robotic crop nutrient application systems. Canada.ca

☣️ Clean Fuel Regulations Update Could Target Fraudulent Used Cooking Oil - Agriculture Minister MacDonald says the Carney government's promise to update Canada's Clean Fuel Regulations could create an opportunity to block fraudulent used cooking oil imports, addressing concerns in the biofuel sector. RealAgriculture

🤝 Prime Minister Carney Launches Business Support Measures - The federal government announced expanded Business Development Bank of Canada loans for small and medium-sized enterprises as part of new measures to protect and transform Canadian strategic industries, with potential implications for agribusiness. Newswire

SUGGESTED READ

Perfect for Sipping Your Morning Brew:

A scrappy tech startup in Tasmania is giving berry farmers the tools to forecast yields using GoPro footage and AI-powered ripeness algorithms.

Today you are you! That is truer than true! There is no one alive who is youer than you.

Want to help the newsletter grow?

Forward this newsletter to a friend or colleague, it’s free!

Until next time,

Prairie Routes News