- Prairie Routes Newsletter

- Posts

- September 17th 🗞️

September 17th 🗞️

It's been a whirlwind of weather this harvest season, let's check out what's to come.

PRAIRIE ROUTES

NEWS

Editor’s Note:

Good morning, and welcome to today’s issue. We have been experimenting with some release times for the newsletter to see how you respond. We have settled on once a week, on Wednesday morning. Please reach out if you have any feedback for us by replying to this email!!

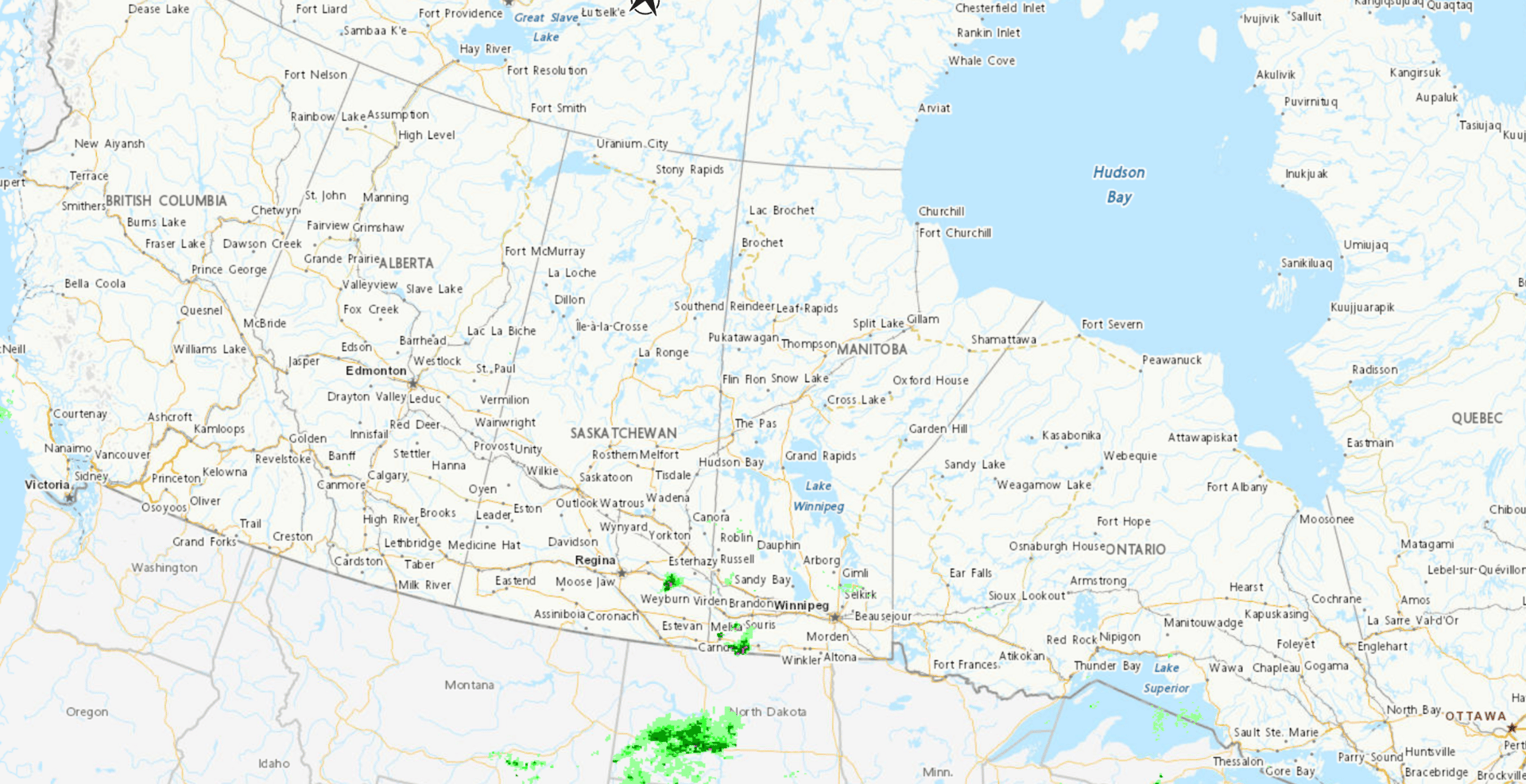

🌤️ The weather forecast looks relatively clear in the prairies this week with decent rain expected this weekend in Manitoba and western Ontario as large systems continue to move north from central America.

Have a great week!

MARKET PULSE

Commodity Market Brief – Sept 17th, 2025

Energy

WTI Crude (Oct ’25, CLV25): $64.60/bbl — steady on Russia supply risks.

Brent Crude (Oct ’25): $67.35/bbl — modest bid, still range-bound.

Nat Gas (Oct ’25, NGV25): $3.153/MMBtu — seasonal demand support.

Nat Gas (Nov ’25, NGX25): $3.400/MMBtu — stronger curve into winter.

Metals

Gold (Oct ’25, GCV25): $3,680.0/oz — bid on lower yields & safe-haven demand.

Gold (Nov ’25, GCX25): ~$3,667/oz — curve keeps premium intact.

Grains & Oilseeds

Soybeans (Nov ’25, ZSX25): $10.50¼/bu — firm but needs export demand.

Canola (Nov ’25, RSX25): C$635.70/tonne — stabilizing, but trade pressure lingers.

Livestock

Live Cattle (Oct ’25, LEV25): $233.45/cwt — easing with softer cash tone.

Feeder Cattle (Nov ’25, GFX25): $349.40/cwt — pressured by demand outlook.

Lean Hogs (Oct ’25, HEV25): ~$97.13/cwt — holding firmer despite weak tone.

🔍 Takeaways

Crude: Range-bound; geopolitics vs OPEC+ supply keep trade choppy.

Gold: Oct/Nov contracts still strong; dips are buyable with Fed cuts in play.

Row crops: Beans and canola stable, but upside depends on exports.

Livestock: Cattle/feeder weakness tracks wholesale values; hogs slightly firmer.

Not financial advice.

Data sources: APnews.com, Morningstar.com, MarketWatch.com, Exchange-rates.org, Agriculture.com, YahooFinance.com, Barchart.com

TRENDS

📈 The Bulls and 📉 The Bears

📈 Bullish Trends

Pea Yields Surpass Expectations

Canadian pea crops—especially yellow, green, and minor classes—are coming in better than many thought. Favorable late summer weather and mild growing conditions are supporting yields. That’s pushing projected 2025-26 pea output toward 3.75 MMT. High carry-in stocks could pressure prices, but strong yield is a boost to overall production outlook.

Increased U.S. Wheat Demand from Asia

Asia millers have been stepping up purchases of U.S. wheat (soft white and hard red winter) due to competitive pricing and delays from Black Sea shipping. That demand shift adds a tailwind for grain markets and offers export opportunity—particularly for producers in Canada who compete on quality and price.

📉 Bearish Trends

Carry-Out Peas Swelling, Prices Sliding

With large upcoming volume from the 2025 pea harvest and over 4.2 MMT of carry-in stocks expected, the supply glut is pushing prices down. China’s 100% import tariff on Canadian peas adds another layer of export risk.

Crop Input Costs Climbing, Pressure on Margins

Farm Credit Canada forecasts sharp increases in input costs in 2026—fertilizer, in particular, remains expensive globally, and Canada isn’t insulated. Rising input costs alongside downward pressure on some crop prices (like soy/canola if trade doesn’t improve) could squeeze farmer returns.

Stocks Revisions Muddy Supply Picture

Statistics Canada’s recent revisions to on-farm stocks (for canola, wheat, pulses) under new methodology pushed some numbers higher than earlier estimates. That makes interpreting “headline stock declines” tricky and may reduce upside surprises. Markets tend to not react strongly when stock reports are confusing.

Want to Sell More Meat and Grain—Profitably?

Prairie Routes connects family farms with seasoned experts for 1-on-1 coaching tailored to your business. Whether you’re looking to grow your market, boost margins, or streamline sales, we’re here to help.

Book your free consult today and see how we can help your farm thrive.

INCASE YOU MISSED IT

4. Quick Hits on Policy and Relevant News

🇨🇦 PM Carney Meets Prairie Canola Leaders on China Trade Crisis Prime Minister Mark Carney convened canola industry leaders from across the Prairies yesterday, joined by Saskatchewan Premier Scott Moe and federal agriculture ministers. Industry leaders detailed how Chinese tariffs are creating significant challenges for Canadian farmers. Carney emphasized federal commitment to supporting affected farmers and highlighted recent measures including $370 million for biofuel production incentives and increased loan limits for canola producers to $500,000. pm.gc.ca

🥛 New Canadian Dairy Hub Launches Dairy Farmers of Canada, Lactanet, and industry partners unveiled a comprehensive bilingual online platform giving Canadian dairy farmers practical resources. The hub focuses on four key themes: environmental sustainability, animal welfare, animal health, and herd management, turning the latest dairy research into accessible information for farmers and advisors. finance.yahoo.com

🇨🇳 Saskatchewan Canola Farmers Anxious for China Tariff Relief Saskatchewan's canola farmers remain anxious for tariff relief as trade talks with China continue. The ongoing trade tensions are putting significant pressure on Prairie producers who rely heavily on Chinese markets for canola seed exports. ca.news.yahoo.com

🫛 Phytokana Secures $32.5M for Fava Bean Processing: Alberta startup Phytokana Ingredients partnered with Vancouver's Maia Farms to turn Canadian-grown fava beans into plant-based food ingredients, with $6.6M from Protein Industries Canada supporting the initiative. vegconomist.com

🤝 EMILI Partners with OCP North America: The agricultural innovation organization announced a collaboration to advance field-based research in Manitoba, strengthening the province's position in agricultural technology development. emilicanada.com

🌾 Canadian Wheat Breeding Review Launched: The Canadian Wheat Research Coalition (CWRC) launched a comprehensive review of Canada's wheat breeding innovation system to enhance competitiveness in global markets. ukragroconsult.com

SUGGESTED READ

To borrow a phrase from today’s Major Projects announcements, supporting vulnerable industry is all about the timing, i.e. current context and long-term outcomes.

Believe you can, and you’re halfway there.

Until next time,

Prairie Routes News

Want to help the newsletter grow?

Forward this newsletter to a friend or colleague, it’s free!